Understanding the Recent SRA Changes to Residual Balances

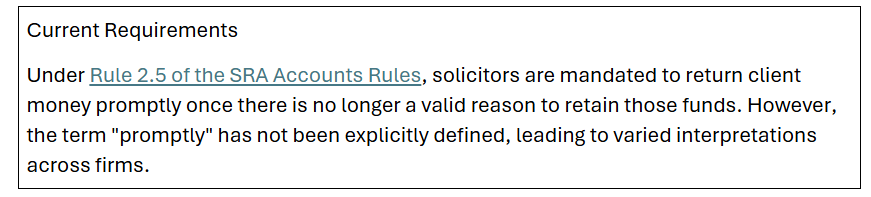

Law firms managing client accounts are well aware of the compliance obligations set by the Solicitors Regulation Authority (SRA). One key area that continues to pose a challenge is the handling of residual client balances—funds that remain in client accounts long after legal matters have concluded. Recent SRA disciplinary actions and renewed guidance have put this issue under the spotlight, urging firms to take a more proactive approach to compliance.

But what exactly are residual balances?

Residual balances refer to unclaimed or leftover client funds in law firm accounts. These amounts may result from minor overpayments, disbursement miscalculations, or simply funds that were not returned to the client after the completion of legal work. While individual sums may seem small, collectively they represent a significant financial and regulatory concern.

A small sized law firm who was recently rebuked for retaining a large sum of residual balances across 369 client matters, fell behind submitting qualified accountant reports said that the pandemic, stamp duty holidays and personal issues of the partners had “severely affected” its ability as a small firm to submit the accountant’s reports and deal with the residual client funds in a timely manner, reinforcing the importance of compliance in this area.

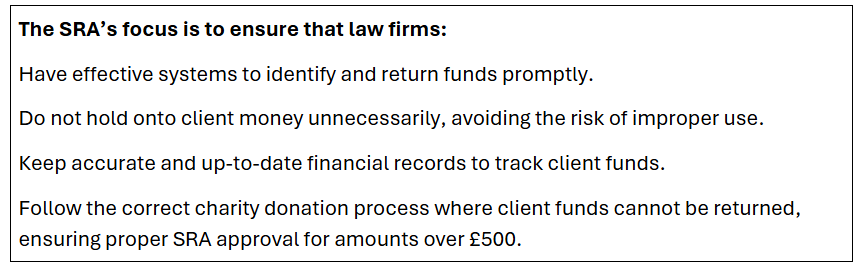

With the SRA tightening its stance, firms need to be proactive in managing residual balances to avoid potential disciplinary action. Here, we’ve put together some tips to help law firm’s ensure compliance:

- Regularly Review Client Accounts – Implement scheduled reviews to identify and address residual balances before they become a compliance issue.

- Strengthen Record-Keeping – Maintain accurate financial records to track all client transactions and ensure transparency.

- Proactively Contact Clients – Make timely efforts to return funds by reaching out to clients via email, phone, or letter.

- Implement a Clear Residual Balance Policy – Establish firm-wide protocols to ensure systematic handling of unclaimed funds.

- Follow SRA-Approved Donation Procedures – When clients cannot be traced, firms can donate balances to charity in accordance with SRA rules.

For many firms, handling residual balances can be time-consuming and administratively complex. This is where outsourcing to a specialist legal cashiering provider, such as Cashroom, can make a significant difference.

Outsourcing provides a proactive solution, ensuring that:

- Client accounts are reconciled properly, preventing funds from being overlooked.

- Residual balances are identified and returned promptly in line with regulations.

- Firms remain fully compliant, avoiding the risk of regulatory action.

- Internal resources are freed up, allowing legal teams to focus on client service rather than financial admin.

With the SRA increasing its focus on residual balances, now is the time for firms to assess their processes and ensure they are fully compliant. Whether through internal improvements or outsourcing financial management, taking a proactive approach will help firms stay on the right side of regulations while maintaining client trust. Cashroom can also look at existing residual balances as a one-off project and get your business up to speed quickly and compliantly.

Are you confident your processes are up to date and fully compliant? Or could there be areas in need of improvement?

Our expert legal cashiering team can help you streamline processes and maintain full compliance with SRA requirements, either as a one off project to get you up to date or ongoing support.

Cashroom provides expert outsourced accounting services for Law Firms including Legal Cashiering, Management Accounts and Payroll services. Our mission is to free lawyers from the complexities of legal accounting by supporting the industry with accurate management information and allowing lawyers to do what they do best – practice law.

‘The Cashroom have been an integral part of MBM from their inception. They has supported the growth of MBM from a small firm of 15 people all the way to the 70+ partners and staff now working in the firm. I have first hand experience of the wealth of skill employed within the business and the cashiering knowledge is unrivalled. The fluid ability of Cashroom to adapt to the changing requirements of a firm on a daily basis, as well as the ability to cover holiday periods seamlessly would be a benefit to any law firm. The Cashroom portal provides a first class workflow system for all cashiering requests and, more importantly, provides the level of security that email instructions do not. Cashroom provide both a cost effective fully outsourced service that can deliver almost everything that an internal finance team would be charged with, as well as a wraparound service to support an internal finance team.’